We would like to wish you all a merry Christmas.

How can small and medium businesses use Revenue Management techniques to optimize their profits? Come and share your thoughts!

Saturday, December 25, 2010

Merry Christmas !

We would like to wish you all a merry Christmas.

Wednesday, November 24, 2010

Price Skimming - Let's ride the demand curve down !

Consumer heterogeneity is the main element of any price skimming – and Revenue Management – strategy. Thus, it is necessary that people have different valuation for the product. An important behavioral element that has also to be accounted for has been brought up by D. Besanko and W.L. Winston: customers’ expectations regarding future prices. Indeed, in their buying process, potential customers weight the benefits of buying today against the benefits of waiting and buying later, which sharpens the time shift in demand.

Stanley Shapiro explains in his book that "A Skimming policy is more attractive if demand is inelastic". A practical definition of an inelastic demand would be that there are no close substitutes, and people are ready to pay a high price for a given product because there is nothing else they can buy that provide them with the same elements (uniqueness, quality, etc).

An important point relates to the use price skimming in absence of any protection against copy. In this case, according to F. Nascimiento and W. R. Vanhonacker, price skimming is optimal for products that can be acquired through either purchase or reproduction. Computer software is a typical example of a product that can be either copied or purchased, and for which price skimming is used to recover development costs and optimize revenues. High prices obviously attract piracy, and Köehler mentions that protection costs may eat up margins.

Inherent risks

When implementing a price skimming strategy, the greater risk that decision makers face is competition. If illegal copy can be seen as a form of unfair competition, the “regular” competition is generally attracted by the high margins that accompany price skimming, and try to enter the market as quickly as possible. The price policy is effective only in situations where a firm has a substantial lead over competition: Apple's iPhone sets the perfect example. After the first iPhone was launched in January 2007, it almost took two years for the first real competitor to appear, RIM's Blackberry Storm… allowing Apple to enjoy high margins, and great market power in the meantime!

The strategic battle between Sony and Microsoft over the video game consoles market is also a great illustration of how crucial the lead on competition can be. When Sony launches the Playstation 2 in November 2000, Microsoft strikes back in November 2001 with the Xbox… and then kicks in first in 2005, introducing the first 7th generation video game console, the Xbox 360. Sony then fought back, launching the Playstation 3 in November 2006.

This pricing strategy can also raise several other issues. Lowering a product's prices could result in negative publicity, if prices are lowered too fast, without significant product changes; as mentioned previously, price should not be perceived as a sign of quality to apply successfully RM techniques. During the first stages, skimming implies very low inventory turn rates, which may be an issue in the supply chain: retailers may require higher margins to distribute the product.

Another strategy mirrors price skimming: price penetration. It will be the subject of a further article...

Wednesday, November 10, 2010

Insights into movie theaters' pricing strategies

This paper proves that if RM concepts and principles are fairly simple to state and understand, building the prerequisites of a RM system can present a structural difficulty to overcome in some industries.

Further research will be carried out on this matter: our goal is to get research data from AMC (which successfully implemented a variable pricing strategy) and Fandango.com (plateform which allows buying tickets online for most theaters), in order to demonstrate how theaters could implement variable pricing models.

Tuesday, October 26, 2010

RM and microeconomics concepts: Why would revenue increase?

Let’s set a business case.

A car park management company is willing to increase its revenue, and change its pricing policy. Currently, they have a fixed fare: $2.40/hour. They would like to draw an estimation of a new pricing policy:

· From 6am to 11am and 3pm to 6pm: $2.40/hour

· From 11am to 3pm and 6pm to 10pm: $3.60/hour

· From 10pm to 6 am: $1.50/hour

Those fares are not the result of any marketing research/interview/survey. The following graphs represent Supply and Demand curves…necessary to evaluate the revenue, and the revenue reached under each pricing strategy.

The park has a total capacity of 150 cars.

Single price optimization

Price discrimination (3 prices)

The incremental gains reach +45% with the change in pricing. The projection is not realistic in the sens that most of the time a car park is not full all day long, but our goal is to show that theoretically, if demand can be segmented, revenue can be boosted.

Let’s make the jargon clearer

Revenue management is the revenue optimization system for an entire company, gathering all the markets: This is a concept of coordination among different markets (eg: Airlines and connecting flights). Yield management aims at maximizing revenue for a given market (Paris-New York on the 7th of August with American Airlines), based on overbooking (to compensate no shows), booking class nesting (to spread demand over off-peak periods) techniques. According to these definitions, Revenue Management is managing the network or the “relationships” between markets.

We can say that a company I carrying out a price discrimination strategy when it charges different prices for a same good (or service) based on customer demand and perceived value. Two levels can be distinguished in a price discrimination strategy: (1) uniform pricing, meaning that if prices may vary depending on customer segments, locations, etc, they do not vary through time (2) dynamic pricing, where prices vary through time, due to different variables, conditions and situations.

Monday, October 4, 2010

Building the pre-requisites to a Revenue Management System

Dear Reader,

Through the threads we started on various RM related group on the professional media LinkedIn, we wanted to know what the community of professionals would think of the application of Revenue Management principles (ie a “RM System” of a kind) to a wider range of companies (in terms of size and sector) (Linkedin group ). A lot of very interesting replies came up, and the bottom line is that many professionals think SMEs could implement RM, but that according to their experience, companies’ management only show a limited interest to complex RM systems:Cost of implementation, return on investment, software solutions cost, dedication of managers to run the system… However, some professionals think those trends are changing, and they take advantage of it to implement RM systems in many companies. In this blog, we also believe that companies can have a mixed approach: We think that they make some simple steps to trigger the optimization of their revenue, without being obliged to implement a complex IT infrastructure.

This feedback from the community made us step into the shoes of a business owner, and wonder if there are pre-requisites to the implementation of RM (whether it is a rule of thumbs applied on Excel as in our previous article, or an advanced RM system) in an organization. Beyond the generic term of perishability, let’s have a look at what the two main theorists, Kaylan T.Talluri and Garrett J. Van Ryzin, highlighted on the subject:

- Customer heterogeneity: Customers must have different buying decision criteria

- Demand variability : Demand has to be impacted by seasons (the customer flow is not homogeneous)

- Production inflexibility: You have limited and constant resources for sale available ( ex : Limited number of rooms in an hotel)

- Price as “non signal” of quality : Customers must not assess the value of the offered product based on the price (as per the luxury industry for example)

- Data and information system infrastructure: Knowing your customers, their habits, and how to make them access what you are selling are key success factors.

- Management culture: How is the company’s management open to implementing solutions to optimize the revenue stream? Do they believe this kind of preoccupation can go beyond the sales department?

Those six pre-requisites can be relatively hard to fulfill depending on your activity / sector / size, and rely on several sub-concepts. Ideally, assessing the elasticity of your demand for example, would require the measurement of the demand variability from a reliable data collection. However, there is a world between theory and being able to build a system which will face that in a corporation. A good way to bridge the gap is to rely on a simplified but easily manageable approach, as presented in our article on Peak Load management.

A multitude of SMEs fulfill the above pre-requisites, but - and that is understandable - with approximations. If many companies can identify their customers, they often display a limited knowledge: Limited number of surveys, quality of historical data, and lack of marketing integration…

At a larger scale, Revenue Management systems seem a priori to need rigor and precision in the setting of its parameters: Knowing that the pre-requisites match your business does not mean you can start a RM System. In the next articles, we will tackle those issues and try to determine what compliance level is needed for each pre-requisite, and how can simplified RM tools meet some smaller scale demand management issues.

RM aims, among many goals, at providing support for pricing decision and demand management. Fulfilling properly the pre-requisites is a first step; however there is a long way to reach this new management system. As explained on this previous article, it implies an evolution of the business model and of the organization.

We will develop a draft of an implementation process of a larger scale RM System in a further article.

Sunday, September 26, 2010

Peak Load pricing, a simplified application of Revenue Management

As explained earlier, the goal of this blog is to spread best practices as well as practical tools and techniques for SMEs to apply Revenue Management to their business. Recalling the principles mentioned in our previous article, one of the common reasons for the implementation of a RM system, is the management of the perishable aspect of a given service, and the high opportunity cost of missed sales. If, on a Saturday night, a theater gets full for a certain movie, it will miss the next sales forever – if we assume the potential customer may not buy a ticket for another movie, which is often wrong.

This leads to a crucial aspect linked with missed sales, a high seasonality factor combined with limited resources: Peak Loads. Peak loads have to be managed in order not to miss any chance to maximize revenue for the market (time period/service). For example, you cannot create instantly new seats or remove them in a theater, so a given capacity has to be optimized. In this article, we will share with you a basic pricing tool that we have developed to help you to manage your peak loads – if your business is concerned. As we will see this requires a minimum of demand forecast, and an idea of your customers’ behaviors versus price changes.

The structure of costs is a good reason for implementing RM techniques: the high share of fixed costs (buildings, maintenance, staff…) makes the business harder to operate and the anticipation of demand key. Indeed, if the variable costs per unit are low, maximizing profit implies maximizing revenue. It is a major aspect, since a common Peak Load strategy is to use the peak period revenues to compensate the losses – if any – generated when business is slower, as the capacity is hardly modifiable over time.

With those high level features and “pre-requisites” for implementing a revenue management system, we can already draw a series of activities where Peak Load pricing strategies are applied, or could be applied:

- Rental businesses

- Hairdressers (explained by Robert Cross in his book)

- Parking lots

- Internet cafes (experimented in 1999 by Easygroup in the UK)

- Public meetings and events

Peak loads or the first critical issue addressed by a RM system

Let’s start with the core subject. Peak load is a key issue, which motivated the creation of RM systems. Is a corporation able to identify peak loads patterns, or not? If yes, can it change the demand to avoid these peak loads? Often, historical data from past cycles or knowing the market patterns are enough. Some companies usually know their customers well, other, have to go through market studies and business intelligence reports to identify customers’ cycles…

Knowing your peak load, when the demand tends to exceed the capacity, is crucial. Even better, is being able to steer your demand and volume. Hairdressers in France for example, found a way to avoid high Saturday afternoon peak times, by opening until late evening during weekdays. Does it work? Does it deter customers from coming massively on Saturdays? Is that enough, or would a price difference spread the demand over more days of the week? Probably, as it is the case in the hospitality industry, where part of demand is transferred to a time period when booking level is low.

On a day to day basis, you don’t take your decisions based on a scientific datamining of past customer behaviors and market information. Indeed, most operational decisions are taken in a degraded situation, without relying on precise quantitative data: a certain level of uncertainty is assumed.

An interesting article article from James Dana, Using Yield Management to shift demand when the peak time is unknown, highlighted the capacity of an organization to manage unanticipated demand. “The equilibrium price dispersion can efficiently shift demand and lower capacity”: the article demonstrate that when companies set prices in accordance to demand at time t, they are able to steer demand. However corporations must be able to set probabilities for sales at a price X and Y (where X≠Y), and then be able to set these prices (X and Y), with the overall constraint of making a profit.

Let’s remind that this constitute a win-win situation, where both the consumer (who pays less, against a tradeoff regarding the time of consumption) and the producer (who achieves a greater profit) increase their surplus.

Our simplified model

We have designed and integrated a simplified peak load management model to this article(see below). From a given capacity and unique price, the model calculates the optimal pricing for the peak and non-peak periods. At the center of this revenue optimization model is the concept of price elasticity. The price elasticity measure the responsiveness of demand to a price change, basically: % change in demand divided by % change in price. We will write a further article on price elasticity estimation. For the moment, we take a basic linear elasticity in our model, which we estimate from your information and a rule of thumb (see below).

This model is highly simplified, and overlooks several important elements. It assumes linear price elasticity, hypothesis that we will review within few days. The results should be put in perspective, taking the following issues into account:

- The competitors reaction

- The size and concentration of the market

- The overall consequences on the marketplace: if every player apply the same pricing strategy, will that expand or shrink the market overall?

- A seasonality pattern that adds to the periodic peak load pattern

Monday, September 13, 2010

How could I apply revenue management to my business ?

Most people associate RM with complicated pricing models, state of the art IT, and high-flying mathematicians. Needless to say, it helps. Revenue Management relies on a few basic principles. Everything is just a matter of implementation, in accordance with the sector, the organization and the size of the company: you don't need SAP to manage a hair salon; you don't need to be a Rube Goldberg machine to take the first steps towards the optimization of your revenue.

Indeed, Robert G. Cross summarizes revenue management with 7 core concepts:

• Focus on price rather than costs when balancing supply and demand

• Replace cost-based pricing with market-based pricing

• Sell to segment micro-markets, not to mass markets

• Save the products for the most valuable customers

• Make decisions based on knowledge, not supposition

• Exploit each product's value cycle

• Continually re-evaluate your revenue opportunities

Principles

Three basic constraints shape the RM practice:

• The ressources available for sale have to be in a fixed/limited amount

• The ressources have to be "perishable": there should be a time limit after which the ressources loose their value

• The different customers must be wiling to pay a different price for the same amount of ressource

If in your business, the costs are mainly made of fixed costs (ie, high % of fixed costs vs variable costs), then revenue management is a key factor to optimize your profit: as variable costs are rather low versus revenue, each increment in revenue will increase cost absorption, and impact directly the bottom line.

To trigger the purchase, Revenue Management uses two main leverages: price and inventory. In the price-based approach, the customer buys as soon as the price has decreased to her/his real or sensed expectations. As we will study in a later article, theaters could optimize their occupancy rates and then boost their sales by using this approach…

Customer segmentation and pricing fences

It's obvious: know your customers.

What segments can you identify among your customers? On which criteria is this segmentation based? What price are the customers from distinct segments ready to pay for your product(s)? How are they sensitive to price fluctuations? What are their purchasing patterns over time?

You should be able to answer each of these questions, ideally with quantitative answers. The idea is to be able to segment customers on the basis of their willigness to pay, and to be able to charge different prices to different customer categories.

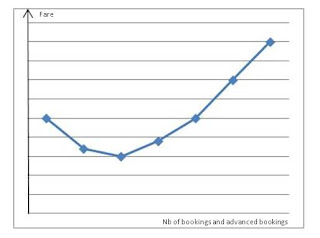

• The time of purchase: as detailed in our previous article, the airline industry charge different fares, depending on the booking time.

• The creation of a costless customer value: concert tickets are a good example. Certain tickets will give personal access to the perfomers before/after the concert, against a substantially higher price, and costing nearly nothing to the organizer.

Of course, this will depend largely on the product type, quantity and the opportunities for offer customization; but the focus has to be centered primarily on the customer.

Marketing management and ethics

Every move towards revenue optimization should be made in accordance with a company's marketing strategy.

As RM relies on price discrimination, it can stir up customer resistance, and harm the customer relationship. Long term customers can end up in the higher price range while expecting a well deserved discount/advantage. As the development of RM systems tended to weaken their customer base, the airline carriers answered by implementing the frequent flyer programs. Thus, RM practice has to be integrated within customer relationship management, has a tool to secure customer loyalty.

It also has to be consistant with the management of the company's image: in 2002, when Deutsche Bahn tried to implement RM on its "frequent loyalty card passengers" ( see article), it faced customer disaprovement and a declining number of passengers, and finally step back to fixed pricing.

In terms of princing, a common fear is that customer segmentation could be based upon unethical criteria. This has to be adressed through the practice in itself, and communicated consistantly.

Our blog

In the following articles, our goal is to illustrate these generic principles. For this purpose, we will study successful and unsuccessful RM practicies in various fields, discuss the potential application of RM principles within small and medium businesses, and try to develop simplified pricing and decision tools.

Sunday, September 5, 2010

Revenue Management and its applications: Airlines

Note that the charts presented above, represent an observed trend, and not precise data to be analyzed in details.

If you would like to have a better understanding on how Revenue Management systems work in a real life case, the MIT proposed a simulation of an Airline Revenue Management.