Amid all the interesting subjects discussed during the conference – markdown pricing, social learning and RMP, cancellation and rebooking issues in travel industry, implementation cases – the issue presented during the plenary session was the most inspiring and representative of the opportunities RMP has created over the past few years. It demonstrated how these techniques have reshaped the electricity supply chain in the US (production, transmission and distribution).

The plenary session was chaired by Shmuel Oren, who is the Earl J. Isaac Professor in the Science and Analysis of Decision Making at the University of California at Berkeley, and served or still serve as consultant of many public utility authorities; his brilliant performance is available here (the closest to what was presented at the INFORMS RMP conference).

We let you, readers, have a look at this video, which will provide you with a clear vision of the organization of this market:

- How the US electricity market is organized from generation to consumption

- How the capacity limits, and the transmission congestion lead to the need of interconnecting the generation zones – 3 in the US – and to the creation of financial transmission rights. This might be close to the concepts of physical and financial availability of seats in the airline industry, where physical availability represents the point of view of accepting a via point booking for one “leg”, and financial availability represents the impact of a booking on the whole network.

- How the market uses the concepts of spot and forward buying of electricity at the macro level (see the status of contracts in RM based industries for other interpretation of the importance of the phenomenon)

- How Europe is unfortunately far from this ideal world, where a wind power plant would never be able to supply more than its transmission right, and not able to buy rights from a next door fossil energy plant

- How the market learnt from past errors (case of Enron which acted irrationally, buying more than the whole market was able to supply), and is now regulated (Financial markets could learn from it)

Let’s focus on the part where Revenue Management is even more tangible: The distribution of electricity to households and businesses. Talluri and Van Ryzin introduced this area as a great opportunity for the implementation of RMP in the practice sections of “The Theory and Practice of Revenue Management” (Chap.10.7).

In our opinion, using RMP to manage electricity, along with congestion management techniques higher up in the electricity production and distribution chain would contribute to:

- Make production sustainable and enable the development and usage of green energies

- Forecast Demand on a very detailed level - households, businesses, factories - to match with generation

- Have an integrated chain

- Build common capacities for multiple distribution

- Manage the capacity constraint with multiple actors, to smoothen capacity needs

In many countries, electricity distribution is already priced differently depending on the time of the day (min 18-20 of the video above). However, little evidence shows that this pricing enables displacing demand off a peak. This is the case in France for example with day/night pricing, but demand is always limited at night time, which does not make it the most effective lever... Segmenting the daytime could represent an opportunity.

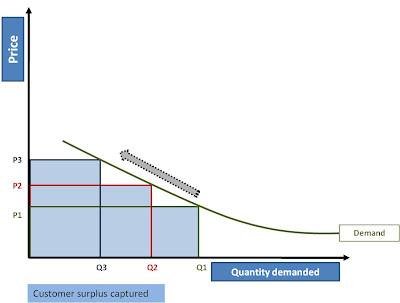

The following figure is an overview of the situation in the US:

The wholesale and retail markets are quite heterogeneous:

- Electricity generation can follow deterministic (nuclear power plant) or stochastic (wind farm) demand, which brings difficulty

- Transmission is key; over the past 15 years, RMP has been implemented and developed in this area

- In the retail market, distribution is hard to address due to the complexity to forecast demand (high volume of data, first of its kind demand forecast for electricity supply market) and the difficulties to segment the market

In 2002, McKinsey consultants, Justin A. Colledge & al., wrote “Power by the minute”, a paper on deregulation and opportunities for RMP to step in the B2C electricity distribution: “Once exposed to electricity prices that vary during the day, consumers are likely to alter their consumptions patterns, especially during critical peak period.”

The past couple of years have seen the emergence, in electricity distribution, of the implementation of smart meters worldwide. Smart meters aim at monitoring the consumption of electricity on the consumer side and bring data to distributors as well. This is basically the first step for distributors before implementing RMP and offering adapted plans or fares to their customers: The use of that information will enable them to consolidate consumption data and to forecast demand deterministically. Going from stochastic to deterministic modelling is a huge step; not only will it enable distributors to assess demand but it will also allow them to smoothen it.

We believe that two issues can be raised this last point:

The toughest challenge is to reach maximum efficiency with a fully integrated chain: as retail demand is aggregated and escalated up to the production level, supply chain issues (such as the bull whip effect) raise.- How can we adapt a deterministic demand distribution model so that it enables to forecast electricity generation from multiple sources? For example wind farms electricity production is hard to forecast, due to intrinsic stochastic behavior of production.

- How can we adapt wholesale pricing (which is very dynamic) to current end customer distribution (which is not dynamic yet)?

In an ideal world, we would have power by the minute. Electricity would be priced at the minute for the customer, who would make the decision to consume or not (at least for some home appliances). In this world, transmission networks capacity would be rationalized, origin-destinations of the electric flows as well as production capacities would be optimized. Producers would therefore be able to forecast, anticipate, and to switch to sustainable energies whenever possible.

One may argue that people are not going to change the way they switch on or off the lights. Nevertheless, there are other appliances at home where adjustment on usage timing could be made; for example, people could choose to differ their use of air conditioners, washing machines, dishwasher and vacuum cleaners. According to the aforementioned McKinsey study, savings for US consumers (households and businesses) could be as high as $15 billion.

A recent study by the Brattle Group, “dynamic pricing of electricity and its discontent” advocates the ability of consumer to change behavior and act according to market supply and pricing. This excellent piece of writing dismantles the negative mythology which surrounds residential dynamic pricing. Even though their argument is aimed at convincing the institutions that regulate the US residential electricity market, the 7 myths they take down make this paper a case for dynamic pricing in general:

"Myth #1: Customers don’t respond to dynamic pricingWe urge you to take a take a look at this paper.

Myth #2: Customer response does not vary with dynamic pricing

Myth #3: Enabling technologies don’t boost demand response

Myth #4: Customer response does not persist over time

Myth #5: Dynamic pricing will hurt low-income customers

Myth #6: Customers have never encountered dynamic pricing

Myth #7: Customers don’t want dynamic pricing"

Another research published in 2009 by the Brattle Group demonstrate that smart metering coupled with dynamic pricing does represent a wonderful opportunity in the EU. "Unlocking the €53 Billion Savings from Smart Meters in the EU" show that the investments required to reach a 100% equipment rate in smart meters in the EU is €51bn. This would lead to improvements in the maintenance of the network (meters are easier to read, outages are detected instantly, theft is easier to control), and thus to savings amounting to €26bn to €41bn only. These operational savings are not sufficient to outweigh the costs. The Brattle Group demonstrates that implementing dynamic pricing could lead to additional savings estimated at €53bn: these savings derive uniquely from cutting the costs linked with the installation, use and maintenance of peak production capacity.

Here again, dynamic pricing represents the opportunity for one of these win-win situations that we love to see happen, and that got us to create this blog.