Earlier this summer, Julien went to the INFORMS Revenue Management and Pricing conference at Columbia University. Held in NYC, this event “is the premier forum for both academics and practitioners who are active in research in the fields of pricing analytics and revenue management”. The objective was to get up to speed with the latest research, practicesand burning topics in the industry.

He was amazed to see how Revenue Management and Pricing (RMP) techniques are developed and widely used in the United States. Most of the conference participants originate from the US and this discipline seems far more advanced there than in Europe. There are business cases in many unconventional areas (e.g. Google, with its Ad Exchange is using RMP techniques to grow the online advertising pie in an unconventional way – more about that in an incoming article), and the markets have really understood the potential of the price dimension in the 4 Ps marketing mix.

We would like to share a few findings with you…

1) The prerequisites for RM revisited

This conference enabled us to put this discipline in perspective; it also got us to rethink several ideas we had about pricing:

2) A taxonomy of RM

Acknowledging RMP by sector is, we believe, not the right level of analysis. After having attended this conference, and thus analyzed the latest research, we believe that RMP could be classified into three core areas.

RMP focuses on the “Maximization of Revenue” through:

As mentioned previously, strong social learning reshapes a market's forces.

We would like to share a few findings with you…

1) The prerequisites for RM revisited

This conference enabled us to put this discipline in perspective; it also got us to rethink several ideas we had about pricing:

- Market power: it is commonly accepted that individual consumers represent a fragmented demand, which doesn’t have much bargain power when it comes to pricing. This statement doesn't hold in a context of "social learning", where information is shared, and expectations tend to converge.

- Market segmentation. For a while, we were wondering which came first: the chicken (pricing) or the egg (revenue management)? Well, for sure, pricing is not a sub-set of RMP (as well as inventory management is)- it goes along with it and is on a higher level of analysis. It has a strategic aspect that would lead RMP in the organization. Actually, proper market segmentation (and calculation of pricing break-even points) is probably the real pre-requisite to any price related activity.

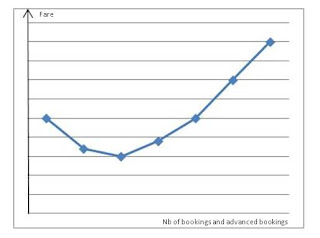

- Price as a signal: It tends to be accepted that RMP cannot be implemented in an organization where the price a signaling characteristic regarding the product. Research has gone further and presents the price as a signaling device of product availability (demand forecast vs. inventory available). On this regard, we are looking forward to the publication of "Markdown Management: Pricing as a Signaling Device", by Gad Allon (Northwestern University), AchalBassamboo (Northwestern University), Ramandeep Randhawa (University of Southern California). Adapting pricing to product availability is an issue that most companies are facing : Who has never wondered what is communicated by the price a good is sold (eg. Used items on ebay, amazon marketplace, craigslist etc)?

2) A taxonomy of RM

Acknowledging RMP by sector is, we believe, not the right level of analysis. After having attended this conference, and thus analyzed the latest research, we believe that RMP could be classified into three core areas.

RMP focuses on the “Maximization of Revenue” through:

- A proper segmentation and an optimized pricing policy: This is a key component when willing to market you product differently to different groups (bundling questions, break-even point for segmentation, demand and promo management). This must be sufficient when no real binding constraint can be found

- The management of a limited inventory: This is the origin of RMP

- The management of a network’s congestion where capacity has a very limited life span, and could not be stocked: This is under implementation by Telcos, Energy providers … Stochastic demand analysis is at the heart of it.

As mentioned previously, strong social learning reshapes a market's forces.

A very interesting presentation dealt with the issue of whether the customers manage to get a rationale and can understand basic RMP concepts. Therefore, they could act upon it and compare the quality of products (don’t mix the comparability of products and their lookalike)

“Our model postulates a fairly simple learning mechanism. Given the number of past agents that purchased and of them the number of agents that liked the product, each agent forms an estimate of the quality sensitivity parameters (QSP) of the marginal agent that purchased and liked the product. The agent then compares this marginal QSP to his own QSP.” In "Monopoly Pricing in the Presence of Social Learning", by B.Ifrach, C.Maglaras, and M.Scarsini.

This presentation offers a vision of customer behavior and its impact on market actors. More to come in a separate article

4) The impact of research on RM practices

The RM industry is interesting in its ability to absorb state-of-the art research, and to always go further into details. Lately, this has resulted in an ability to:

- Build disruptive and even more robust RMP : several business case emerged for various new industries. Demand shocks management is one of them.

- Use an industry minded research, with a focus on reality: Cancel and rebooking behavior and how to act upon

- Build incremental innovation: Bundling services and its efficiency

- Gather a growing number people from various horizons and nationalities

Boarder line subjects are lightly emerging and we are thrilled to see that coming.

Once again, through this blog, we are trying to explore how organizations can implement Revenue Management and Pricing techniques.

The first hurdle we have to overcome is the financial evaluation of a RMP project. Several options are available: i) The traditional NPV, ii) an NPV model associated with a Monte Carlo simulation (used by Hilton Hotels’ Revenue Management), iii) through an option-like valuation (This method, and the business case for RMP will be available later on this blog). Let’s not neglect the other aspects: the strategic fit, Finance and cash flow considerations, the existing IT infrastructure, People and the corporate culture, and the Marketing and Communication.

Implementing RMP should also mean bringing superior value to the organization. That is the article that we have initiated earlier and that we will keep on updating.

In short, this conference helped us realize how fast the Revenue Management and Pricing field is moving. In order to get a grasp of how innovative and far reaching RMP is, we will publish a couple of industry focused articles within the next few weeks.

Thanks for following us!

Julien & Yoann