Most people associate RM with complicated pricing models, state of the art IT, and high-flying mathematicians. Needless to say, it helps. Revenue Management relies on a few basic principles. Everything is just a matter of implementation, in accordance with the sector, the organization and the size of the company: you don't need SAP to manage a hair salon; you don't need to be a Rube Goldberg machine to take the first steps towards the optimization of your revenue.

Indeed, Robert G. Cross summarizes revenue management with 7 core concepts:

• Focus on price rather than costs when balancing supply and demand

• Replace cost-based pricing with market-based pricing

• Sell to segment micro-markets, not to mass markets

• Save the products for the most valuable customers

• Make decisions based on knowledge, not supposition

• Exploit each product's value cycle

• Continually re-evaluate your revenue opportunities

Principles

Three basic constraints shape the RM practice:

• The ressources available for sale have to be in a fixed/limited amount

• The ressources have to be "perishable": there should be a time limit after which the ressources loose their value

• The different customers must be wiling to pay a different price for the same amount of ressource

If in your business, the costs are mainly made of fixed costs (ie, high % of fixed costs vs variable costs), then revenue management is a key factor to optimize your profit: as variable costs are rather low versus revenue, each increment in revenue will increase cost absorption, and impact directly the bottom line.

The goal is to maximize revenue for a given product, within a certain time horizon: the company should aim at providing each unit to the customer exctracting the highest price possible from the customer base. Ebay is a good illustration for this, and a simple way to encompass these principles for any product.

To trigger the purchase, Revenue Management uses two main leverages: price and inventory. In the price-based approach, the customer buys as soon as the price has decreased to her/his real or sensed expectations. As we will study in a later article, theaters could optimize their occupancy rates and then boost their sales by using this approach…

In opposition to this, Talluri and Van Ryzin, in their book The Theory and Practice of Revenue Management, highlighted the quantity based view, where the leverage used is the remaining inventory. As most applications of Revenue Management occurred in industries where the inventory is critical and highly perishable, the inventory approach is prevalent today.To trigger the purchase, Revenue Management uses two main leverages: price and inventory. In the price-based approach, the customer buys as soon as the price has decreased to her/his real or sensed expectations. As we will study in a later article, theaters could optimize their occupancy rates and then boost their sales by using this approach…

Customer segmentation and pricing fences

It's obvious: know your customers.

What segments can you identify among your customers? On which criteria is this segmentation based? What price are the customers from distinct segments ready to pay for your product(s)? How are they sensitive to price fluctuations? What are their purchasing patterns over time?

You should be able to answer each of these questions, ideally with quantitative answers. The idea is to be able to segment customers on the basis of their willigness to pay, and to be able to charge different prices to different customer categories.

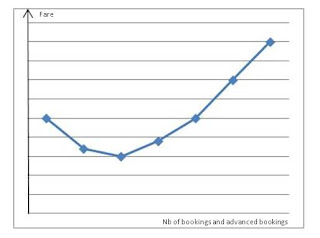

• The time of purchase: as detailed in our previous article, the airline industry charge different fares, depending on the booking time.

• The creation of a costless customer value: concert tickets are a good example. Certain tickets will give personal access to the perfomers before/after the concert, against a substantially higher price, and costing nearly nothing to the organizer.

Of course, this will depend largely on the product type, quantity and the opportunities for offer customization; but the focus has to be centered primarily on the customer.

Marketing management and ethics

Every move towards revenue optimization should be made in accordance with a company's marketing strategy.

As RM relies on price discrimination, it can stir up customer resistance, and harm the customer relationship. Long term customers can end up in the higher price range while expecting a well deserved discount/advantage. As the development of RM systems tended to weaken their customer base, the airline carriers answered by implementing the frequent flyer programs. Thus, RM practice has to be integrated within customer relationship management, has a tool to secure customer loyalty.

It also has to be consistant with the management of the company's image: in 2002, when Deutsche Bahn tried to implement RM on its "frequent loyalty card passengers" ( see article), it faced customer disaprovement and a declining number of passengers, and finally step back to fixed pricing.

In terms of princing, a common fear is that customer segmentation could be based upon unethical criteria. This has to be adressed through the practice in itself, and communicated consistantly.

Our blog

In the following articles, our goal is to illustrate these generic principles. For this purpose, we will study successful and unsuccessful RM practicies in various fields, discuss the potential application of RM principles within small and medium businesses, and try to develop simplified pricing and decision tools.